My idle thoughts on tech startups

Alibaba S-1: Sizing Up A Giant

As I’m sure you’ve heard, Alibaba officially filed to go public yesterday. I believe this may be the most anticipated tech IPO of all time… some may argue Facebook was a bigger deal, but Alibaba’s offering has been “in process” for a long time and may very well be the largest IPO ever both in terms of size of offering and initial market cap of the company.

As I’m sure you’ve heard, Alibaba officially filed to go public yesterday. I believe this may be the most anticipated tech IPO of all time… some may argue Facebook was a bigger deal, but Alibaba’s offering has been “in process” for a long time and may very well be the largest IPO ever both in terms of size of offering and initial market cap of the company.

My S-1 deconstructed posts over the years (Facebook, Groupon, Kayak, et al) have usually been a single long read. Alibaba simply too big of a company and there’s way to much in this S-1 to do it in a single shot. But there’s a ton of interesting bits on everything from growth rates to corporate governance, so I will still do a deep analysis though will serialize this into a couple posts. I’ll first start with a brief background on the genesis of Alibaba and a top level sizing of the company and its underlying businesses.

===================================

Alibaba’s Genesis Alibaba was founded in 1999 by Jack Ma and 17 other colleagues, and like most startups they began as a small group working out of Ma’s apartment in Hangzhou. The initial business, Alibaba.com, was a B2B marketplace to enable global buyers of manufactured goods to connect with Chinese wholesalers and suppliers of such goods. At the time B2B marketplaces were huge in the US… during the late ’90s bubble companies like VerticalNet and others were valued in the tens of billions.

By the late ’90s the economic reforms of Deng Xiaoping had helped propel China into an upward growth trajectory but this was still two years before the term “BRIC” was created. For perspective, China’s entire economy has grown more than 600% since Alibaba was founded. Even more staggering… when Alibaba started there were 9 million Chinese people on the internet. By the end of 2013 there were 618 million, or growth of nearly 7,000%. Clearly betting that the internet in China would be “big” someday has paid off for Alibaba.

Just How Big Is Alibaba? You may know that Alibaba is a huge company and may also know that it has several underlying businesses. Here’s a quick breakdown for you.

- Alibaba/1688.com – this is the B2B marketplace for connecting wholesale buyers worldwide with Chinese manufacturers and distributors for a range of goods. While B2B was the origin of the company, the Alibaba/1688 marketplace has evolved more towards a complementary business to the rest of Alibaba in that much of the use of the B2B marketplace is by sellers on Alibaba’s retail marketplaces (Taobao, Tmall, Juhuasuan) to source their goods. Today the B2B (aka wholesale) portion of the business only accounts for about 11% of Alibaba Group’s overall revenue.

- Taobao – this is a “P2P” or “C2C” marketplace for relatively small sellers to connect with retail buyers for goods. It’s not a perfect analogy but broadly speaking it’s similar to eBay, though the vast majority of Taobao transactions are fixed price rather than auction format.

- Tmall – this is the B2C marketplace, where large companies can sell directly to retail buyers. Akin to Amazon.com, Tmall is primarily used by large brands like Nike, Gap, and others to sell online in China.

- Juhuasuan – this is a group buying or flash sale marketplace. People compare it to Groupon frequently which helped pioneer “flash sales” in the US, though Groupon historically has sold a lot of service based offers (restaurants, spas, etc) whereas Juhuasuan is primarily products like a Zulily, Gilt, etc.

- Alipay – this is the payments arm of Alibaba, usually compared to PayPal in the US. A key distinction is that the primary benefit of PayPal originally was to enable small merchants to accept electronic payments seamlessly, at a time when most had to rely on checks and money orders in the mail. Alipay’s primary benefit is as an escrow service ensuring the seller gets paid and the buyer gets their purchase, which gives comfort to both parties in a Chinese society where the rule of law and trust between individuals can be a greater concern than in the US.

- China Smart Logistics – this is a JV that Alibaba Group owns 48% of, created in partnership with the 5 largest delivery companies in China (e.g. the UPS, FedEx, DHL equivalents). This lets sellers on Alibaba’s marketplaces connect effectively with packing and delivery providers, and for consumers to seamlessly track and manage delivery of their purchases.

Alibaba Group doesn’t break out revenue by each marketplace, though they do separate the revenue from China vs rest of world and between wholesale and retail commerce. They also break out the revenue of ancillary businesses like the web services unit.

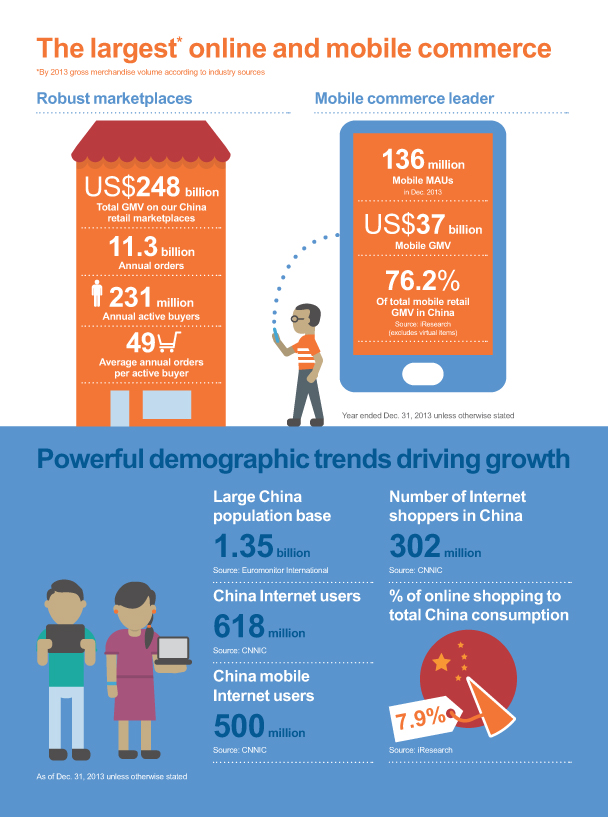

So just how big is Alibaba Group? Well I’ve included below one of many infographics in the S-1 that gives you some of the hard stats. No matter how you slice it, the numbers are fairly staggering.

- A Quarter Trillion in GMV – total gross merchandise volume (GMV) for Alibaba Group was $248B USD in 2013. Let me repeat that… a quarter trillion USD. eBay’s GMV for 2013 was $76 billion and Amazon’s was about $100B. So that makes Alibaba Group about 40% larger than Amazon + eBay combined in terms of total goods sold.

- 11 Billion Orders – Alibaba processed 11.3 billion orders in 2013 across 231 million active buyers, so roughly 50 orders per active user.

- Half A Trillion in Payments – total payment volume (TPV) through Alipay was $518B USD in 2013. For reference, PayPal was $180B USD in TPV in 2013, which makes Alipay nearly 3x bigger than PayPal.

With all those mind blowing stats though, Alibaba did roughly $8.5B USD in revenue for 2013. In that regard it’s only about 1/2 the size of eBay/PayPal and means that the revenue per transaction is far lower. In my next post I’ll do a deeper dive into exactly how each of Alibaba’s businesses monetizes and try to compare those to the analogous US-based companies.