My idle thoughts on tech startups

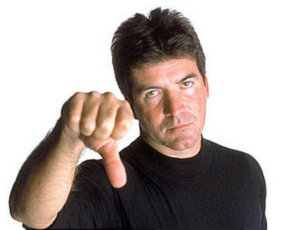

The Quick “No” Manifesto

A frequent complaint by entrepreneurs is that VCs fail to provide a prompt “no” to startups which they don’t plan to invest in. There’s lots of reasons VCs do this… we have an incentive to preserve an option to invest as long as possible (rightly or wrongly), saying “no” is rarely an enjoyable thing to do, internal consensus building within a VC partnership can take time. But that doesn’t excuse what is a legitimate and understandable complaint.

A frequent complaint by entrepreneurs is that VCs fail to provide a prompt “no” to startups which they don’t plan to invest in. There’s lots of reasons VCs do this… we have an incentive to preserve an option to invest as long as possible (rightly or wrongly), saying “no” is rarely an enjoyable thing to do, internal consensus building within a VC partnership can take time. But that doesn’t excuse what is a legitimate and understandable complaint.

Over the last five years I’ve tried to be timely with my feedback to entrepreneurs seeking capital, including those in which I don’t intend to pursue an investment. I’ve certainly had my failings here, but for me it’s never been an intentional effort to “hang around the hoop” and hopefully on balance I’ve done a decent job with the prompt “no”. But I’d like to do better at this. I know I can be both more consistent with an explicit no and provide it promptly (hopefully days or a week or two, not many weeks or even months).

I hope that other angel and VC investors strive for the same. But perhaps the flip side of this effort can be a mutual respect and understanding by entrepreneurs seeking capital. Specifically:

1) Detailed Reasoning – If at all possible, I will try to provide reasons why I’m passing on a particular investment opportunity. Sometimes I simply don’t spend much time because an initial glance rules it out of my typical investment criteria, in which case I may have little detailed reasoning. Certainly if I’ve spent a good amount of time with an entrepreneur learning their business, I will try to provide specific feedback that is hopefully constructive.

But it’s not always possible or practical to get into my detailed rationale for not pursuing a particular investment. Candidly it’s not always possible to communicate reasons for passing in a rational, constructive, and concise fashion and if I feel I need to do all three to provide useful feedback.

2) Trying to Convince Investors They’re Wrong – Another challenge potential investors face is that simply saying “no” becomes a catalyst for a lengthy debate in which entrepreneurs try to convince investors they’re wrong. When I’m skeptical about an investment opportunity, whether based on the product, the market, the team, the revenue model… I genuinely hope I’m wrong and the founders prove themselves right through their success. But engaging in such a debate is rarely fruitful for either party and just as I respect their ingenuity and zeal, I hope entrepreneurs who seek investment from me can respect my own perspectives.

Entrepreneurs often have an evangelist mindset, which can be useful when convincing early customers or early employees to join their cause. But successful startup fundraising isn’t about convincing the skeptics they’re wrong. It’s a sales process to identify and qualify the investor prospects who are believers and are a fit with the founders.

3) Asking Aggressively For Referrals – Sometimes a startup is very compelling, but the particular investment opportunity sits outside the scope of my own interests (due to stage, sector, or other general factors). When this is the case, and I know of other specific investors who I believe may be a good fit, I will gladly volunteer an introduction without prompting.

Often though entrepreneurs who hear a “no” ask for referrals from that prospective investor, either reflexively or because they’ve received advice to do so. There are legitimate differences of opinion on this topic, but my own is that asking for intros from an investor that has declined is rarely a good option. If their reasons for passing are non-specific to the company (stage, sector, geography, etc) then let them volunteer an intro or ask “gently”… aggressively seeking referrals is likely to get you very weak intros (at best). If an investor is passing for company specific reasons, any intros you get from that person will be negative signals (“why is he introducing me to an opportunity he passed on?).

=================

I pledge to be better, both about providing quick “no” and hopefully quick “yes” responses. Hopefully in return the dialogue between entrepreneurs seeking capital and prospective investors can be both an efficient and respectful one.