My idle thoughts on tech startups

Putting Twitter’s IPO in Perspective

As many of you know, in the past I’ve done a series of posts deconstructing the S-1s of VC-backed internet startups going public. A few years ago this was sort of a novelty… not that many startups were going public and not that many bloggers or mainstream journalists took the time or had familiarity with combing these SEC filings. But now there’s a lot of info reported and a number of good, thorough analyses of S-1s as we enjoy a quiet but very real “boom” in the tech economy.

Twitter’s IPO has garnered a ton of attention in the tech and popular press. So their revenue figures, pre IPO financing and ownership, and other info is all widely available. I thought I’d provide a little analysis of Twitter based on their S-1, but also strive to put it in a broader context of other consumer internet businesses and where we are in the current tech cycle.

Three Ways to Make Money On the Consumer Internet

I authored a post seven years ago (geez… time flies!) on the three ways to make money on the consumer internet. The emergence of mobile platforms has broadened the array of internet-enabled businesses somewhat, and overall it obviously marks a massive shift in computing platforms. But at its base level, ubiquitous computing or “mobile” hasn’t actually changed that much from the desktop web when it comes to fundamental business models.

Again there’s three fundamental ways to make money in consumer-facing internet businesses: you can sell people stuff in a physical realm (e-commerce), you can indirectly monetize consumer attention (media or ad-based), or you can provide online software & services that consumers pay for (premium services). There’s different flavors or derivations of these… e-tailers and marketplaces are both e-commerce businesses but differ in operational model, growth patterns, and profit margins. Games monetized via in-app purchases are a premium service. But at the end of the day I’m a simple guy and subscribe to Occam’s razor… all else being equal, the simpler explanation of something is generally better.

Twitter Is A Media Business

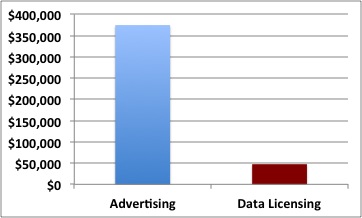

Despite it’s long-standing protestations, Twitter is indeed a media company. If this were a math class, I’d just say the proof is evident but if you want some data on Twitter’s 2013 YTD revenue here you go.

So Twitter is a media business given nearly 90% of their revenue is advertising and the company expects “data licensing revenue to decrease as a percentage of our total revenue over time”. Facebook is a media business. In an unconventional way, Google is also media business, though their consumer “attention” is intent-based rather than time-based. TripAdvisor and Yelp don’t get as much hype as Twitter or Facebook, but they too have built very large audience/media businesses.

If Pinterest and SnapChat turn out to be big businesses, they’ll be media-based businesses. That’s why some smart investors believe they’re worth $3-4B each despite being pre-revenue. Instagram hadn’t built a true business (e.g. revenues –> profits –> cash flows) yet when they were acquired, but they had built a very successful product with great potential to build a business.

Value of Media vs E-Commerce vs Premium Services

Tomorrow we’ll know Twitter’s market cap definitively, at least near term. Since they upped their IPO pricing range to $23-25/share the offering will imply a market cap of $12-14B, but where it will stand after the first day of trading is anyone’s guess and most of the guesses are $15-20B+.

Why are media businesses so valuable? Well it’s not clear that media businesses, in aggregate, are inherently more valuable than e-commerce or premium services companies in aggregate [see Note 1 below regarding categorization]. In the consumer realm, there are more e-commerce companies that will go public this year than media-based startups. For e-commerce you have RetailMeNot (not a traditional e-tailer but still e-commerce nonetheless), Zulilly (great analysis here by Greg Bettinelli), and of course Alibaba on the horizon. There are also a bunch of other e-commerce companies which may have the potential to go public in the not too distant future like Wayfair, Fab, One Kings Lane, and others. But with the exception of Alibaba none of these will businesses worth $10B+ (I plan to do a detailed analysis of Alibaba when they file).

There haven’t been any consumer internet companies with premium service business model to go public in 2013 here. The last one to do so was arguably Zynga, as gaming is a category consumers have clear willingness to pay for, and Supercell had an M&A exit which valued the whole company at around $3B. But there are several premium services business waiting in the wings with potential to be standalone public companies like Dropbox, Evernote, Spotify, and others. And of course Netflix has been public for years but has enjoyed stupendous momentum as a public company in the past 12-18 months.

So there’s arguably more e-commerce and premium services companies that have gone public in the last 1-2 years than media/audience businesses. But with media-based businesses, the distribution of outcomes is markedly different in part because the value capture by new disruptive startups is different. Google, Facebook, and Twitter have each created a new audience-based paradigm and thus have created and dominated a new segment of advertising. Prior generations of media companies typically get little or no share of the new ad markets that are created, meaning the lion’s share of value flows to these new innovative platforms making them exceedingly valuable businesses.

While there are many new standalone companies that are built in the e-commerce and digital premium services segments, a lot of value is also captured by legacy players in each category. Amazon dominates e-commerce, but Nordstrom, Wal-Mart, et al have non-trivial e-commerce businesses of their own. Similarly for every Supercell and Zynga, there’s also big mobile gaming franchises built by legacy publishers like EA.

Growth IPOs Are Back

One other way to put Twitter’s IPO, and other consumer & B2B IPOs recently, in context is the broader macroeconomy and investing environment. A couple things factor into this.

1) Skepticism of Startup IPOs is Behind Us – A few years ago there was exceptional dubiousness of new technology companies, which along with the tech crash of ’01-02 and recession of ’08-09 strongly contributed to the IPO drought from 2003-2010. Yes there’ve been high profile missteps for Facebook’s IPO and companies which have underwhelmed like Zynga and Groupon. But the broad success of both consumer and business facing companies new to the public has meant the prevailing bias against tech IPOs has been replaced with a healthy balance between enthusiasm and skepticism. Investors can debate valuation, but it’s patently obvious that Facebook, LinkedIn, Workday, TripAdvisor, and many other startup IPOs of the last 1-2 years are great businesses.

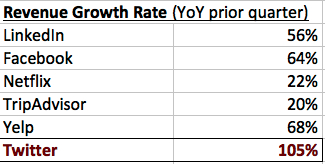

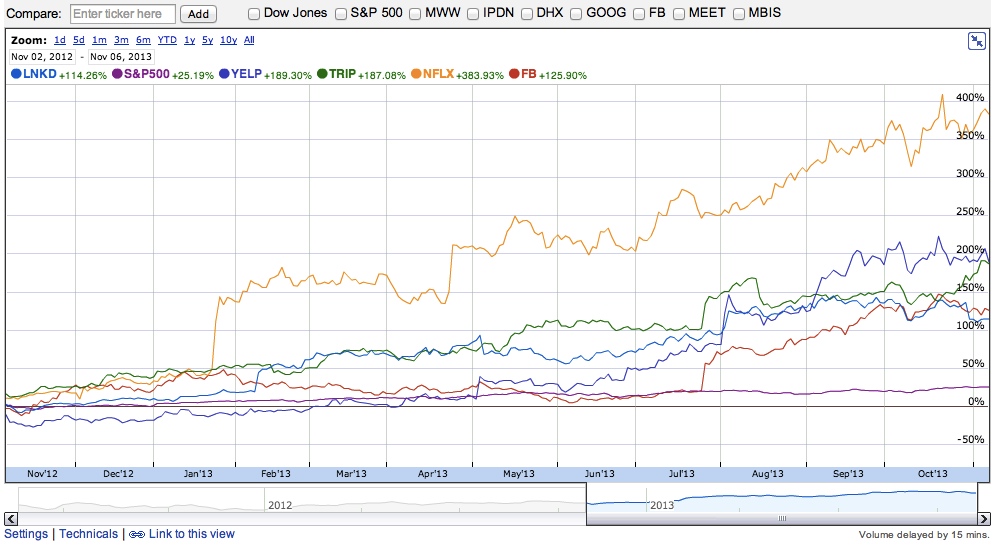

2) Growth is Prized – We live in an unusual time where the confluence of near zero yields, QE, underlying technology innovation, low macro growth, and worldwide demographic shifts have produced an environment where growth potential is especially prized by equity investors. The tables below show year over year growth rates based on last quarter’s reported results followed by stock price over the last 12 months for a group of companies all of which have seen 100%+ rises in share price. To be fair the broad equity markets are up strongly over this time period, but clearly growth has been strongly favored. And for what it’s worth, a lack of growth or the departure of former growth has been penalized by the market as well (just look at Zynga).

So viewed through this lens, it’s pretty clear why Twitter will be valued highly tomorrow… it’s a media-based success in an environment ripe for high growth consumer internet businesses. I wish all of those involved with Twitter very well.

==================

Note 1: Most consumer internet businesses can be put into one of the three buckets pretty easily. LinkedIn is a little unusual in that it’s essentially a B2B SaaS business, a consumer premium services business, and a media business all wrapped together. One could argue Groupon is a “media” business in that they “sell” the attention of their consumers to small businesses, but I think of Groupon really more like an e-commerce business… they directly facilitate transactions and their gross margins work like a commerce rather than a media company.