My idle thoughts on tech startups

Are Google-Scale Outcomes More Frequent?

Something has clearly changed within the last 5-6 years in terms of the speed with which monster startups are created in the software and internet space. As a result of a convergence of many factors (lean startup methodology, broadband & smartphone penetration, social web, cloud computing, etc), breakout startups are clearly getting scale faster than they used to.

There’s lot of anecdotal evidence for this:

- Seed stage investors (including NextView and many of our peers) are seeing more startups progress from seed to Series A stage in 6-9 months rather than 12-18

- Revenue ramp of Groupon and Zynga –> Kleiner famously said Zynga was the fastest growing company they’d ever invested in, no mean feat for the original backers of Google, Amazon, Netscape, etc, and Groupon might be the fastest ever startup to reach $1B in revenue

- Multi-billion dollar valuations for late stage startups like Dropbox, et al

There’s one school of thought that the paradigm has changed, and startups that achieve a market value of tens of billions or more will be more frequent than in decades past.

I’m not so sure that’s the case. What if the new paradigm is simply that software and internet startups accelerate much faster than before, but terminal velocity so to speak remains the same? It’s the difference between Google-scale outcomes being a once in a decade event or something that happens much more frequently.

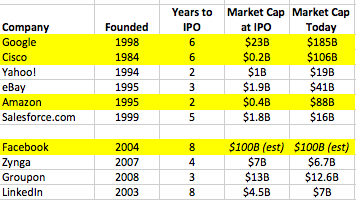

The table above highlights some of the most significant VC-backed startups of the last 25 years. I know Cisco’s really more of a hardware company than software, but I think it’s still relevant to this question. You could throw companies like VMware in here too (~$38B mkt cap) but that was a spinout of EMC rather than a pure startup. It’s also worth noting that in the last 5-10 years breakout startups have remained private much longer than in decades past, so more of the equity appreciation has been captured by private investors than public market investors.

In looking at the table, you see that startups reaching the rarefied air of a $75-100B+ market value (either as a private or public company) are extremely few and far between. This list is hardly exhaustive, but I could only think of CSCO in the ’80s and AMZN in the ’90s and GOOG in the ’00s, and again none of them reached this value until years after IPO.

Facebook will pretty clearly achieve this here in this decade, and undoubtedly there will be more massive standalone companies that are built in the coming years and decades. And to be clear, I take nothing away from the likes of Zynga, Groupon, LinkedIn, Salesforce, Yandex, and other companies which have achieved multi-billion dollar values in recent years… it’s an incredible achievement. I’m obviously biased but LinkedIn’s revenue growth is actually accelerating now (>100% year over year) so I think it’s market value will grow commensurately in the years ahead. But one would be hard pressed to say that other than Facebook, there will clearly be a company out of this crop that will be worth $100B in the foreseeable future.

To me, the new paradigm is one in which companies can often start with less capital than and can grow at a markedly faster pace than before. For everyone in the startup ecosystem this is a pretty incredible state of affairs. But I think we must be cautious is letting ourselves believe that as a result, there will be another Google or Amazon every year.